UK citizens fear the surveillance and financial stability risks associated with a government-issued digital currency.

A recent survey by the Bank of England and Her Majesty’s Treasury has dampened ambitions to introduce a central bank digital currency.

CBDC Question Still Available: UK Survey

a A survey of 50,000 British citizens It revealed concerns about surveillance and that its digital nature would allow customers to quickly move money around and cause financial instability. Others expressed concern about the future of cash.

Despite attempts by the central bank to allay privacy concerns, CBDC system that tracks balances gives users unparalleled insight into spending habits that third parties can exploit, He says Susanna Copson from Big Brother Watch.

An example of this is the system China eCNYwhich must comply with socialist ideals that include information censorship.

It is not unreasonable that governments can limit spending on merchants who politically polarized. The UK government has repeatedly denied accusations that it would program central bank money in this way.

next to, Although large transaction limits may cause less stability From a financial point of view, smaller limits can reduce the attractiveness of a central bank digital currency.

The UK bill could reduce the attractiveness of CBDCs

The United Kingdom was studying A central bank digital currency through various projects which tests settlement techniques and associated asset transfers.

The Bank of England completed a real-time gross settlement test in April to synchronize the movements of the BOE Symbolic origins between books accounting. The test precedes a wholesale settlement service that the bank will launch in spring 2024 to reduce counterparty risk.

next to, Rosalind Projectrecently completed, tested peer-to-peer hash transfers, while new sandbox Enables the exchange of digital values through technology blockchain.

But all evidence can then be moot The government will pass a new bill that legalizes the commerce of cryptocurrencies. Cryptocurrencies, while not completely anonymous, offer some protection against surveillance.

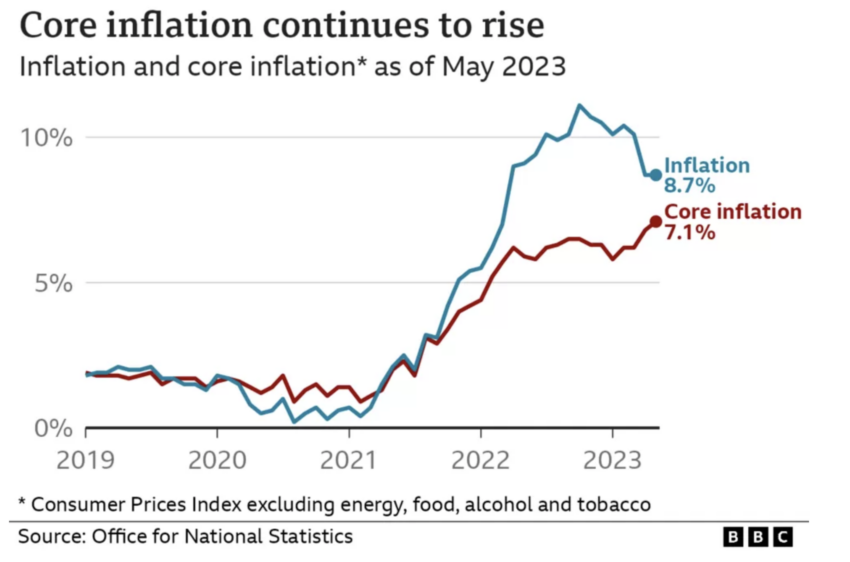

Moreover, the BoE’s fight against inflation still seems far from won, With a core inflation rate of 7.1%. in May.

The cost of living crisis has left many citizens unable to pay their expenses bills or buy enough food. As a result, cryptocurrencies can provide an alternative monetary system to help those most affected.

Disclaimer

Disclaimer: In accordance with the Trust Project’s guidelines, BeInCrypto is committed to fair and transparent reporting. This news article aims to provide accurate and timely information. However, readers are advised to independently check the facts and consult a professional before making any decisions based on this content.

“Subtly charming bacon junkie. Infuriatingly humble beer trailblazer. Introvert. Evil reader. Hipster-friendly creator.”