09:21

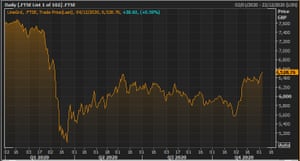

European stock markets are also mostly higher in early trade, with the FTSE 100 out of the box rest:

European Stock Markets Dec 04, 2020 Photo: Refinitiv

09:19

A truck collects copper ore from below the surface at the Chipoloma copper mine in Zambia’s Copper Belt region. Photo: Rogan Ward / Reuters

The price of copper, often seen as a leader in economic demand, reached an eight-year high this morning.

This highlights the optimism of the vaccine, and the push for a new US stimulus package, which raises confidence.

Here’s a Reuters take:

By providing support to the economy during the winter season, the additional stimulus should reduce the risk of a double-dip recession, “ANZ said in a note.

Three-month copper, often used as a barometer of global economic health, on the London Metal Exchange rose 1.3% to $ 7,772 a tonne, its highest level since March 2013, and up 3.4% on a weekly basis.

08:52

Oil reaches its highest level in nine months after the OPEC + agreement

Oil companies are helping It pushed the FTSE 100 to a nine-month high this morningAfter the OPEC group and Russia agreed on a production deal.

After much wrangling, oil producers have agreed to increase production by only 500,000 barrels per day from January. This is rather less than the two million barrels per day they had previously caught.

The decision means oil production will modestly increase next month, when current supply cuts expire.

The news pushed the price of Brent crude to $ 49.92 a barrel this morning, near the $ 50 mark for the first time since early March.

Shares in energy companies are also rising, with the Royal Dutch Shell And the BP Both increased by 2%.

However, OPEC + also agreed that future production levels will be determined in monthly meetings, creating the possibility of tensions in 2021 … especially if crude oil prices continue to rise, luring suppliers to pump more.

08:26

The FTSE 100 hit a nine-month high

Good morning, and welcome to our renewed coverage of the global economy, financial markets, the eurozone, and business.

After a difficult year, it was Britain FTSE 100 ending 2020 in full swing.

The leading stocks index jumped to a new nine-month high this morning, as investors hope 2021 will bring better economic times.

The FTSE 100 gained 40 points, or 0.6%, to 6,530 – the highest level since the first week of March, when global markets were in a state of collapse as the Covid-19 pandemic spread around the world.

FTSE 100 Index this year Image: Refinitiv

The rally comes as momentum builds behind a new US $ 908 billion coronavirus stimulus bill proposal in America. Bipartisan Home problem solving pool To CNBC on Thursday.

Republican Rep. Tom Reid told CNBC last night that the tide on Capitol Hill is shifting in favor of bargaining to pass a new economic stimulus package.

The bottom line is, it is true within the domain of the mind. It’s not a perfect bill, but it’s a compromise bill that can bring people together. ”

Optimism that Covid-19 vaccines will soon be introduced is also leading to a stock rally in London (despite a report in the Wall Street Journal that Pfizer has had some supply chain issues).

Fiona Cincotta From Gain Capital explains:

The news that Pfizer has cut its goal of deploying a COVID vaccine in half due to supply chain hurdles has dampened perceptions of risk. Vaccine optimism put markets in excellent shape during November, as investors pricing in the end of the pandemic and reverting to pre-pandemic growth, regardless of the painful few months expected before a vaccine becomes widely available. Then the news from Pfizer suggests that it may now take longer to reach the end of the pandemic tunnel, but with other vaccines emerging as well, this is a setback rather than a risk-reset news.

However, optimism surrounding the large economic stimulus package in the US helps lift US futures after the close. A $ 908 billion bailout package in the world’s largest economy now appears within reach, providing support for the global risk sentiment picture, removing some of the disappointment with vaccines.

Wider markets could be muted until the release of the latest US unemployment report (1.30pm GMT), which shows how many jobs were created in America last month.

There is a wide range of guesses, from more than 700,000 to less than 200,000, as economists try to assess the impact Its worsening epidemic.

But on average, job creation is projected to slow, to less than 500,000 new jobs in November from 638,000 in October, as Covid-19 cases and deaths rise relentlessly in the United States.

Anthony Barton

(@ ABartonMacro)🇺🇸🎯 Primary trader #NFPGuesses

SocGen 735K

MS 630K

City 600 k

Parks 550 thousand

Mizuho 550k

UBS 505K

BMO 500K

Daiwa 500 thousand

500,000 Germans

GS 450K

Wells Fargo 425k

400,000 BNP

CS 400 k

Scotia 400 K.

NatWest 375 KB

RBC 375K

HSBC 350K

JPM 350 KB

Jefferies 340 K.

Nomura 320KB

TD 200 thousand

Boa 150 k

Average 412.5K

schedule of work

- 9.30 am GMT: UK Construction PMI for November

- 1.30pm GMT: US nonfarm payrolls report for November

- 3pm GMT: US Factory Orders

Updated